The Hidden Cost of Insulin: Are You Eligible to Join the Fight Against Price Fixing?

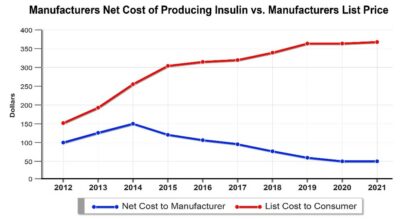

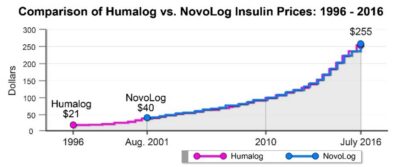

Of the over 38.4 million Americans diagnosed with diabetes, roughly 7 million of them use insulin. In recent years, skyrocketing insulin prices have left many scratching their heads, wondering how such a critical, life-saving drug could become so unaffordable. Behind the scenes, a complex collusion of pharmacy benefit managers (PBMs) and drug manufacturers have artificially raised the cost for patients and insurance companies in “lockstep” with each other to maximize their profits, and intentionally making cheaper insulin products less available.

Of the over 38.4 million Americans diagnosed with diabetes, roughly 7 million of them use insulin. In recent years, skyrocketing insulin prices have left many scratching their heads, wondering how such a critical, life-saving drug could become so unaffordable. Behind the scenes, a complex collusion of pharmacy benefit managers (PBMs) and drug manufacturers have artificially raised the cost for patients and insurance companies in “lockstep” with each other to maximize their profits, and intentionally making cheaper insulin products less available.

If you’re a government or corporate entity with a self-funded healthcare plan, you may be eligible to hold these companies accountable, and recover significant damages.

Who Is an Ideal Plaintiff?

This multi-district litigation (MDL) case represents the entities that provide self-funded healthcare plans for their employees. Specifically, the ideal corporate or general plaintiff will:

- Operate a healthcare plan insuring at least 500 employees;

- Use a self-funded healthcare model, meaning the organization pays out-of-pocket for medications directly to a pharmacy, rather than through premiums to a private insurer, and

- Holds a direct contract with one of the “big three” PBMs: Optum, Express Scripts, or CVS/Caremark, for pharmacy benefits.

Why Does This Matter?

Insulin price-fixing affects millions of patients, but its financial effects also burden employers and other entities managing self-funded healthcare plans. These organizations often pay grossly inflated prices for insulin and other vital medications.

Understanding the Damages

The financial impact of price-fixing can be staggering. Here’s how it breaks down:

- Insulin has been a life-saving medication since the early 1900s, with no major modifications to the drug since its development.

- Approximately 4% of covered lives under a healthcare plan are typically insulin users or rely on other high-cost drugs at issue.

- Insulin manufacturers have raised the cost of their insulins over 1,000% over the last decade alone.

Approximately 25% of funds spent on healthcare in the U.S. is spent on caring for diabetes patients, including insulin costs,

Approximately 25% of funds spent on healthcare in the U.S. is spent on caring for diabetes patients, including insulin costs,- Each eligible insulin user overpays an average of $4,000 annually in overpayment.

For instance, if your healthcare plan covers 1,000 lives, approximately 40 individuals would be insulin users. That’s $4,000 per person, per year, or $160,000 annually, in overpayments. Additionally, because the case involves a Racketeer Influenced and Corrupt Organizations (RICO) claim, plaintiffs may be entitled to recover triple damages. For example, under RICO, $160,000 in annual overpayments could translate into $480,000 per year in potential damages.

How Far Back Can Claims Go?

Depending on your specific contract, the conduct in question may date back as far as 2011. Over more than a decade, these overpayments can add up to millions of dollars in damages.

If your organization meets the eligibility criteria, taking legal action could not only help recover these losses, but also bring accountability to an industry that’s been plagued by a lack of transparency. Contact us here at Herd Law Firm at 713-955-3699 or at www.herdlawfirm.com to explore your options!

Image source: Truven Health Analytics/The Washington Post